OVERVIEW

Artificial Intelligence (Al) is quickly proving to be one of the most significant innovations of the modern era. Its influence is already visible in our daily lives, workplaces, and institutions—and it’s only accelerating.

Much like the Industrial Revolution mechanised physical labour, Al is beginning to automate many aspects of cognitive work. Tasks once performed by teams of people can now be handled or accelerated by intelligent systems. This change will alter the structure of industries, reshape job functions, and open new avenues for economic growth and investment.

Al is not a fleeting trend—it’s part of a long-term shift in how societies and economies operate. For investors, being on the right side of this digital transformation will be essential. Venture capital, in particular, plays a critical role in financing this disruptive innovation. Many of the most transformative Al companies—from foundational model labs to application-layer businesses—are being built and scaled privately. Investors who allocate to venture capital can position themselves at the forefront of value creation, well before these technologies reach public markets.

VC POWERING Al DISRUPTION

According to data from Pitchbook, Al-related companies accounted for 64% of capital invested in US VC-backed companies in the first half of 2025. This is up from just under 49% in 2024.

VC firms are funding companies at all stages of the Al technology stack. These include:

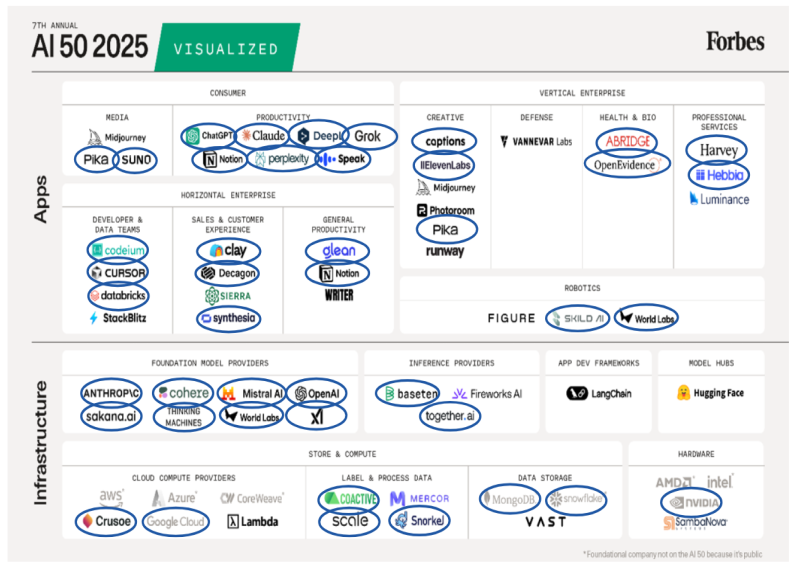

- Foundation Models: Developers of general-purpose LLMs such as OpenAl, Anthropic, Mistral Al, and Together Al, focusing on building scalable, safe, and high-performance foundation models.

- Tooling & Infrastructure: Companies like Databricks (unified analytics and Al platform),

Crusoe (Al-optimised compute infrastructure powered by stranded energy), and Thinking Machines (data science infrastructure for enterprises). - Vertical Applications: Domain-specific platforms including Abridge (clinical conversation Al), Harvey (legal Al copilot), Hebbia (financial document intelligence), Anysphere and Lovable (software development), and Glean (Al-powered workplace search).

- Generative Media & Interaction: Innovators like Synthesia and ElevenLabs (synthetic video and voice), Pika and Suno (Al-powered visual and audio content generation), Notion (integrated Al productivity suite), and Replit (developer tooling enhanced by code generation agents).

Al companies that have raised capital in the last six months include the following:

Raised $40bn at a $300bn post-money value in August 2025. Hit $12bn of ARR in July 2025, doubling revenue in seven months. Investors include Khosla Ventures, Thrive Capital and Andreessen Horowitz.

Raised $3.5bn at a $61.5bn post-money value in March 2025. Hit $4bn of ARR in July 2025, growing 4x since the start of the year. Investors include Spark Capital and Lightspeed Venture Partners.

Raised $900m at a $9.9bn post-money value in June 2025. Surpassed $500bn of ARR in June 2025, having only been founded in 2023. Investors include Andreessen Horowitz, Accel Partners and Thrive Capital.

Raised $150m at a $7.2bn post-money value in June 2025. ARR hit $100m in early 2025, with expectations of $200m+ for the next year. Investors include Kleiner Perkins, Lightspeed and Khosla Ventures.

While many of today’s leading Al companies are demonstrating remarkable progress, we remain in the early innings of the Al revolution. As with past technology shifts, the first wave of applications often mimics the tools and workflows of the previous paradigm—layering new capabilities onto old structures. These early efforts typically aim to boost efficiency or reduce costs, rather than fundamentally rethinking how work is done in an Al-native world. For investors, the more profound opportunity lies ahead: in the emergence of Al-native applications that are designed from the ground up around intelligent systems—and increasingly built as full-stack, vertically integrated platforms.

THE MOVE TO Al-NATIVE FIRMS

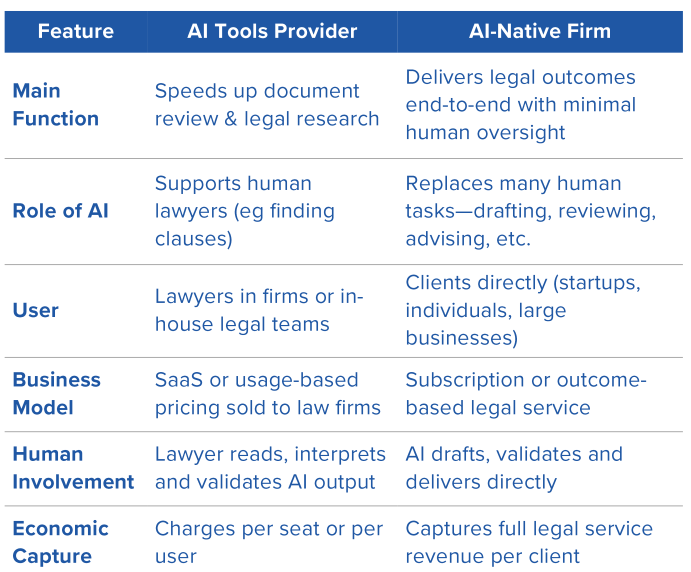

Vertically integrated Al-native firms don’t just use Al to enhance existing workflows—they use it to deliver the end product or service directly. Instead of selling software to traditional providers, Al-native firms operate as the providers themselves. The table below shows how an Al-native firm in the legal industry would compare to a legal Al tools provider:

While many early Al leaders may begin as specialised tool providers, the most ambitious are likely to evolve into full-stack Al-native firms—owning the entire product experience and delivering end-to-end outcomes for their customers. This shift doesn’t just improve efficiency, it also expands their addressable market significantly.

Over the next decade, Al-native firms are likely to capture a growing share of global labour income by automating tasks that have traditionally been performed by human workers. Today, labour accounts for over half of global GDP, representing the single largest pool of economic value in the world. As Al systems take on increasingly complex workflows—in law, finance, healthcare, customer service, and moreAl-native companies will shift from enabling human productivity to replacing or absorbing entire job functions. This transition won’t just drive cost savings; it will fundamentally reshape the flow of economic value from wages toward software-driven service platforms. For investors, this marks one of the most significant capital reallocations of the 21st century.

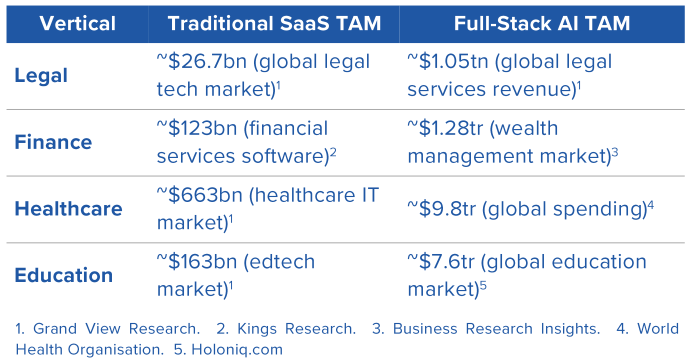

As the table below shows, Al-native firms can address 10-100x larger markets by delivering solutions as opposed to software products.

One of the most powerful promises of Al-native firms is their ability to democratise access to high-quality services—for example, legal, healthcare, and education—that have historically been expensive, slow, or inaccessible to large parts of the population. Just as Uber broadened access to chauffeured rides—transforming what was once a luxury into an everyday convenience—Al-native providers are making expert-level services available at radically lower cost and with near-instant delivery. Importantly, Uber didn’t just disrupt; it grew the market and created new forms of employment. Similarly, Al-native firms may not only displace traditional gatekeepers, but unlock entirely new markets and serve customers who were previously priced out. This shift has the potential to expand economic inclusion, even as it transforms the structure of legacy service industries.

What we’ve seen so far is just the beginning. Over the next five years, Al systems will evolve from isolated assistants into collaborative multi-agent teams—capable of coordinating complex workflows like running a sales cycle, preparing legal documentation, or drafting technical proposals. Personal Al agents will also become more common, managing tasks like scheduling, budgeting, and travel on behalf of individuals. These changes won’t just make work more efficient—they signal a future where every company will need Al at the core of its operations to stay competitive. This will drive massive disruption across industries, creating new winners and rendering many incumbents obsolete. For investors, the most valuable businesses of the next decade will be those built with Al at the foundation, not just as an add-on.

However, we have to recognise that alongside the promise of new industries and productivity gains, Al will also cause significant disruption in the short term. Many jobs are likely to be displaced faster than replacement roles are created. This will create real challenges for societies and will require a coordinated efforts from policymakers to balance innovation with stability. For investors, this underscores both the scale of the opportunity and the transitional risks that historically accompany any major technology shift.

ACCESSING THE Al OPPORTUNITY

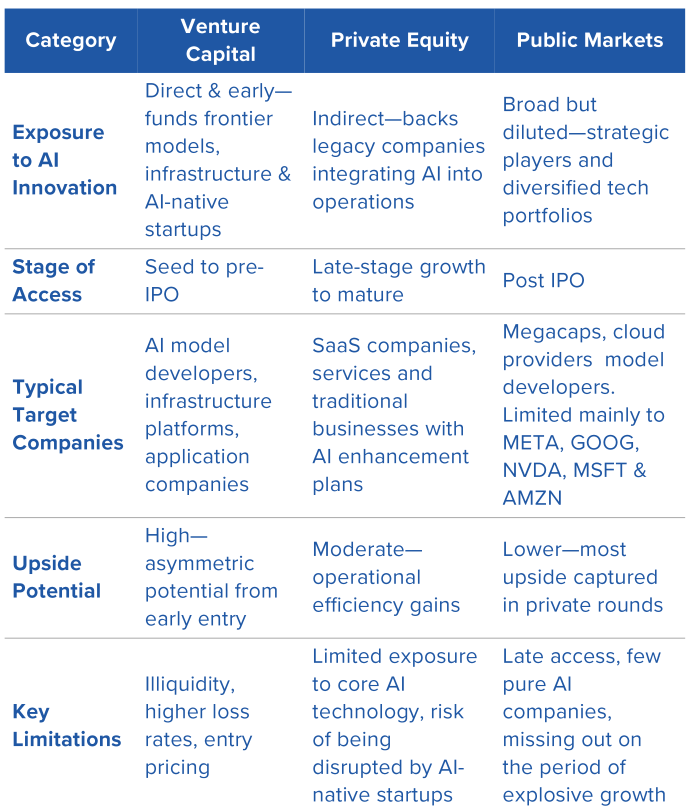

Investors seeking direct exposure to the Al revolution face a critical question: which asset class offers the most direct access to the companies shaping the future? While Al is a theme that touches nearly every corner of the capital markets, not all exposure is created equal. The table below compares the three primary pathways—venture capital, private equity, and public equities.

While other asset classes may offer some exposure to Al through large platforms or mature incumbents, only venture capital provides direct access to the companies driving disruption—at the very point when their growth is fastest and value creation most significant. This disruption is already playing out across high-margin, information-heavy sectors such as legal, finance, customer service, and digital content—areas traditionally shielded from automation but now increasingly served by Al-native platforms.

Industries like legal, finance, healthcare, and customer service—together representing over $9 trillion in annual global spending—are heavily reliant on repetitive, high-cost labor, making them prime targets for Al-driven disruption. Companies such as Harvey (legal), Abridge (clinical), Hebbia (financial research), and Anysphere (software development) are already proving that Al-native platforms can deliver faster, cheaper, and often better outcomes than traditional incumbents. For investors, this marks both a risk and an opportunity: incumbents that fail to adapt risk obsolescence, while early-stage Al challengers are rapidly gaining traction. As adoption accelerates, the window to access these future category leaders at the venture stage is narrowing.

SELECTING THE BEST VC MANAGERS

Gaining meaningful exposure to the Al revolution requires more than simply backing any fund with “Al” in its mandate. The most effective venture strategies will focus on accessing the small set of established firms that are repeatedly earning allocation in the top Al deals. Firms like Andreessen Horowitz, Lightspeed, Khosla Ventures, Thrive Capital, and Kleiner Perkins have demonstrated a consistent ability to source, back, and help build the leading Al-native companies—often from the earliest stages.

While there is growing interest in specialist Al-focused managers, the most consistent and valuable exposure to top-tier Al opportunities still comes from these large, multi-stage platforms. They have the networks, reputation, and infrastructure to win access to oversubscribed rounds—and critically, they also have the capital reserves to support companies through the heavy compute and talent costs that come with scaling Al infrastructure and products. In an era where the leading Al-native companies may raise hundreds of millions (or even more for the foundational model firms), this deep capital base can be a competitive advantage.

As can be seen by the chart below, VenCap’s Core Manager investment strategy has provided investors with early exposure to many of the leading Al startups—including OpenAI, Anthropic, Anysphere, Harvey, Synthesia and Glean. In total, VenCap Funds have exposure to 68% of the top 50 startups in the Al sector as compiled by Forbes earlier this year.

It is this ability to consistently access a high proportion of the very best companies across successive technology cycles that sets these Core Managers apart from the rest of the VC industry. While there are a growing number of emerging managers focused on the Al space, it is an impossible task for Limited Partners to select which may ultimately prove successful.

BALANCING RISK AND OPPORTUNITY

Investing in venture capital, particularly in early-stage Al companies, carries meaningful risk. These businesses often operate in unproven markets, face significant technical and commercial hurdles, and require substantial capital before reaching profitability. Returns in venture capital follow a power law distribution: most companies will fail, and the majority of value will be concentrated in a small number of breakout winners. Crucially, many of the companies that look like early winners today will ultimately not make it. Strong initial traction, rapid user growth, or high-profile funding rounds can mask weaknesses in defensibility, scalability, or unit economics that only become visible over time. The history of past technology waves is littered with early market leaders that disappeared or were overtaken by later entrants.

VC also presents structural challenges, including illiquidity, long time horizons, and elevated entry valuations—especially in the most competitive segments of the Al market. Investors may find themselves deploying capital at premium prices, with no short-term liquidity and limited visibility into eventual outcomes. These risks are real—but they are also manageable.

Thoughtful portfolio construction is the best defense: diversifying across fund vintages, stages, and managers; pacing commitments over multiple years to smooth timing risk; and prioritising access to top-tier firms with a proven ability to identify and support enduring companies. This approach improves the odds of owning the true long-term category leaders, while reducing exposure to overhyped early movers that later fade.

Still, despite these risks, the greater danger may be underexposure. Al is not a cyclical theme—it is a generational shift that will transform industries, displace incumbents, and redefine how value is created. The most important companies of the next two decades are being built now—and overwhelmingly, they are being built in the private markets.

SUMMARY

Artificial Intelligence is not just a new technology wave—it’s a structural shift in how economies are organised and value is created. Much like the Industrial Revolution transformed physical labour and industrial output, Al is redefining knowledge work, software, and services at an unprecedented pace and scale.

This transformation is being driven by a new generation of Al-native firms—companies that don’t just build tools, but deliver end-to-end services powered by intelligent systems. These firms are vertically integrated, full-stack by design, and aim to displace entire industries, not just enhance existing workflows.

The implications for investors are significant:

- Al-native firms can address markets 10-100x larger than traditional SaaS tools by capturing full service value rather than incremental productivity gains.

- Global labour income—one of the largest sources of GDP—is in play, as Al automates tasks previously performed by humans, particularly in high-margin sectors like law, finance, and healthcare.

- Access to these companies is increasingly concentrated in venture capital, where investors can participate in value creation before public markets get access.

As Al redefines entire industries, the most significant value creation is happening inside private companies building Al from the ground up. For investors, this makes venture capital not just an option—but a strategic necessity. Gaining exposure early, through the firms backing these Al-native leaders, may be one of the clearest ways to capture long-term upside as the technology reshapes the global economy.