MIFIDPRU 8 DISCLOSURE

FOR THE YEAR ENDED 31 DECEMBER 2024

Introduction/Overview

VenCap International plc (“VenCap” or the “Firm”) is authorised and regulated by the UK Financial Conduct Authority (the “FCA”) under firm reference number 122451. VenCap is engaged in the supply of investment advisory services to institutional and corporate clients in the field of venture capital fund investment, predominantly the family of VenCap venture capital funds-of-funds. The Firm does not advise retail clients, it does not hold customer assets or client monies, and all assets managed or advised by VenCap are administered by independent third-party administrators and custodians.

The provisions for public disclosure of the Firm’s risk management objectives and policies, governance arrangements, own funds requirements and approach to remuneration are set out in MIFIDPRU 8. Under the Investment Firms Prudential Regime (“IFPR”) and the MIFIDPRU section of the FCA Handbook, VenCap is categorised as a non-small and non-interconnected (“Non-SNI”) investment firm and this document has been produced in order to meet the MIFIDPRU 8 disclosure obligations as applicable to Non-SNI investment firms.

These disclosures are prepared on an annual basis solely for the purposes of complying with the FCA rules at MIFIDPRU 8 for Non-SNI investment firms and are published annually on the Firm’s website

www.vencap.com. The disclosures have not been audited, however, they are subject to internal review and verification and are approved by the Firm’s Board of Directors. The reference date of the disclosures is 31 December 2024, being the same as the Firm’s accounting reference date.

VenCap’s disclosures are considered to be appropriate to its size and internal organisation, and to the nature, scope and complexity of its activities in line with the MIFIDPRU guidance rules. The Firm may consider it appropriate to publish updated disclosures more frequently should a significant change in its business or operating environment require this.

Significant changes since last disclosure period

There have been no significant changes since the last disclosure period.

Governance Arrangements

The governing body of VenCap is the Board of Directors (the “Board”). The Board is responsible for the overall management of the Firm, establishing and monitoring the effectiveness of the corporate governance framework, and for determining the Firm’s business strategy and risk appetite.

The Board has delegated the day-to-day running of the Firm to the Chief Executive Officer, and he is assisted by the senior management team in the execution of this task. Together, the Chief Executive Officer and senior management team ensure that the Firm has in place adequate and appropriate systems and controls, including segregation of duties, and that the Firm is properly resourced and skilled to achieve the Firm’s business strategy and objectives.

The Firm’s Senior Management Arrangements Systems & Controls (“SYSC”) roles and responsibilities matrix identifies all key areas of the Firm’s business and operations and documents those individuals responsible for each key area. This matrix is reviewed and ratified at least annually by the Board.

The Firm’s Conflicts of Interest Policy is approved by the Board on an annual basis and sets out the Firm’s arrangements in connection with the identification, documentation, escalation, and management of conflicts of interest. Directors and employees are required to provide VenCap’s Compliance Manager with a record of their business interests to assist the Firm in identifying any potential conflicts of interest before they occur.

Board Committees

The Board has established a risk management framework appropriate for the size and nature of VenCap’s business. The risk management framework includes an Audit Committee, Remuneration Committee, Investment Committee and Treasury Committee reporting to the Board. The Firm is not required to have a separate Risk Committee – the Board has instead taken the approach that it is appropriate for all members of the Board to be responsible for managing risk in the Firm.

Audit Committee

The role of the Audit Committee is to assist the Board of Directors of the Company in fulfilling its responsibilities in respect of:

- overseeing the company’s financial reporting process;

- the manner in which the company’s management ensures and monitors the adequacy of financial, operational and compliance internal controls and risk management processes designed to manage significant risk exposures; and

- the selection, compensation, independence and performance of the company’s external auditors.

Remuneration Committee

The role of the Remuneration Committee is to recommend appropriate remuneration for VenCap International plc employees to the Board. The Remuneration Committee shall meet at least annually to review levels of remuneration, including carried interest incentives, for all employees.

The Remuneration Committee is responsible for ensuring that the Firm’s remuneration policy makes no discrimination in terms of age, gender, race, disability, religion or belief, gender reassignment, sexual orientation, marriage and civil partnership, pregnancy and maternity, and does not breach any law.

Investment Committee

The Investment Committee is the decision-making body for all investment recommendations made to the manager of the VenCap funds, and comprises at least three members.

Treasury Committee

The role of the Treasury Committee is to consider and (as applicable) approve or recommend strategies and policies to the Board in relation to areas of treasury management including (but not limited to) liquidity management and forecasting, and management of interest rate and currency risk exposures.

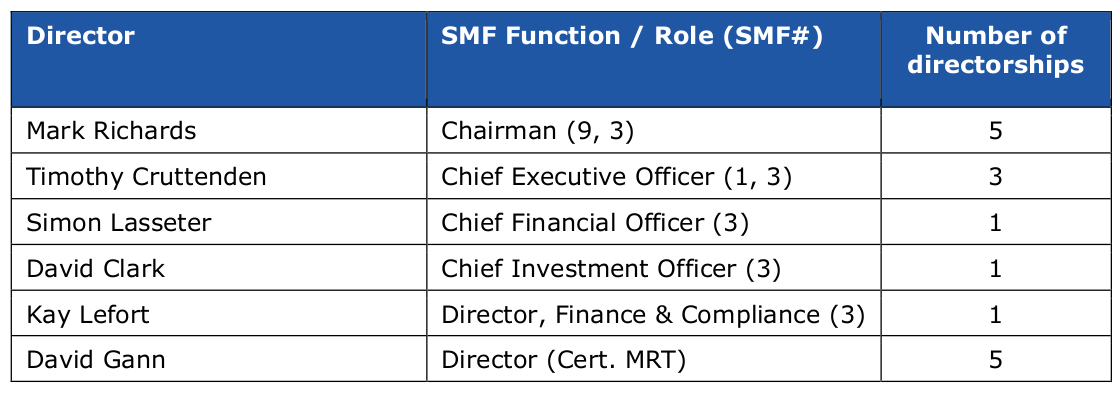

Directorships held

The number of executive and non-executive directorships held by members of the Board as at

31 December 2024 are as follows:

Directorships held with linked entities are counted as a single directorship and those in

non-commercial organisations are excluded.

Diversity

VenCap is committed to encouraging a diverse and inclusive culture among its workforce and management team with a broad range of views, experiences, skills, backgrounds and values represented throughout the Firm. The Firm recognises the benefits of a diverse team and values the innovation and creativity it brings.

VenCap’s goal is for our staff complement to be truly representative of all sections of society and for each employee to feel respected and able to give their best. The Firm’s environment cultivates inclusiveness so that everyone feels able to participate and achieve their potential, pursuing initiatives in recruitment, mentoring, training, and being supported to succeed at work. VenCap believes that everyone has the ability to make an impact and the contributions of all staff are recognised and valued.

The Firm’s commitment to promoting a diverse workplace is set out in the Firm’s Inclusion, Diversity and Equality Policy. This seeks to create a working environment free from bullying, harassment, victimisation and unlawful discrimination, promoting dignity and respect for all, and an engaged workforce who demonstrate inclusive behaviours.

The Firm recognises this is an area of ongoing development and continues to promote diversity through firm-wide activities including hiring practices and training and awareness sessions.

Board recruitment and diversity

The Firm approaches diversity in the broadest sense. In reviewing its composition, the Board consider the benefits of having a broad range of views, experiences, skills, backgrounds and understands that diversity, equality and inclusion play a critical role in establishing strong governance and maintaining a healthy culture from the top as part of delivering higher standards of conduct and success of the business.

Risk Management Objectives and Policies

Risk is considered by the Board as a whole. The annual risk assessment considers the impact of each material risk on the Firm, its clients and counterparties, and on the market; the probability of each risk occurring and the procedures in place for mitigation. This risk assessment applies a scoring system to the impact and probability to rank serious risks appropriately and manage them effectively. The assessment also considers emerging risks.

The Company Compliance Manager identifies, assesses, and monitors the nature and extent of risks (regulatory, investment, operational and business) facing the Firm and presents a report to the Board of Directors at its regular strategy meetings, thereby providing assurance to the Board on its management of risks. The annual risk assessment is evaluated by the Board as to the effectiveness of the system of internal controls to manage the risks the Firm faces.

Operational risk is managed by the directors and senior management, who have responsibility for implementing appropriate controls for the business. The compliance function reviews the operation of these controls and reports to the Board.

The Firm’s main concentration risk is that it is a fund-of-funds advisor focussed on venture capital fund investments. The Firm’s advisory fees are otherwise not subject to the vagaries of short-term market corrections and are predominantly index-linked. The Firm is able to diversify its investment portfolio: the funds it advises are very well diversified in terms of exposure to different sectors, stages and geography but it is not really exposed to asset concentration risks that could increase the Firm’s credit risk.

VenCap’s liquidity policy is to maintain more than sufficient liquid resources to cover any cash flow requirements. The Directors continually monitor income, expenditure and related cash flows to ensure that the Company has surplus liquid capital to meet its ongoing and future requirements, and the Firm continues to maintain cash resources well in excess of its regulatory requirements.

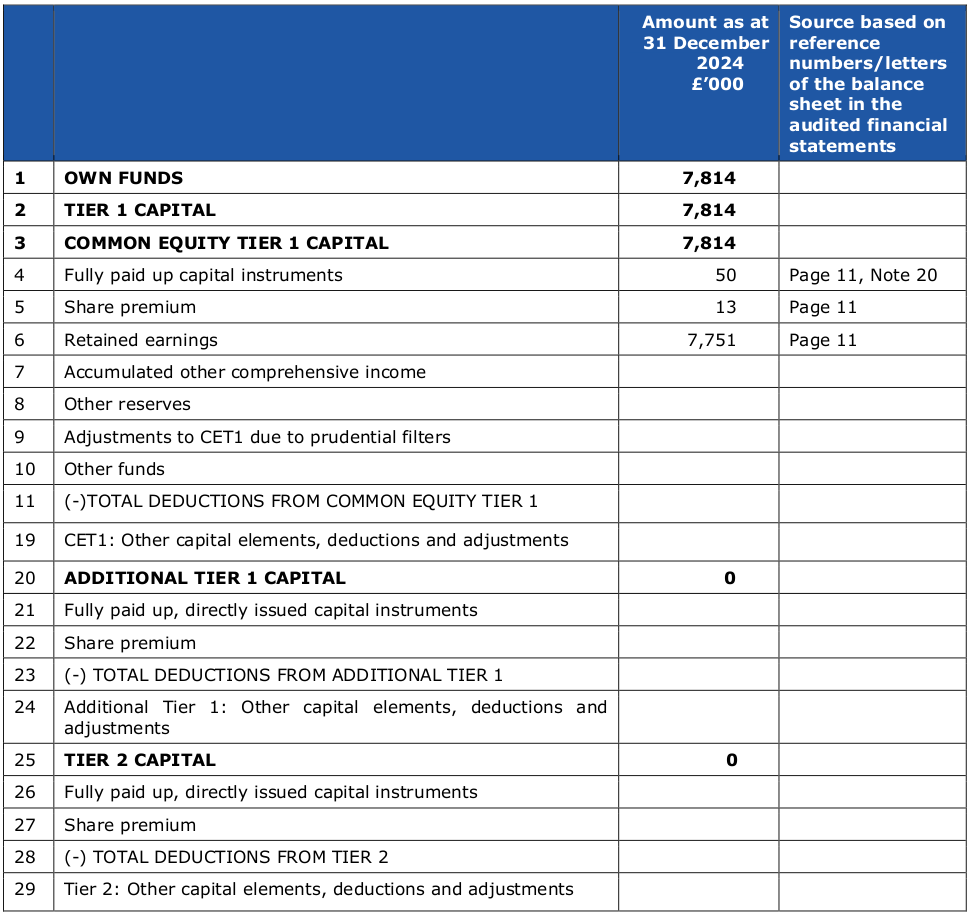

Own Funds

The Firm’s capital resources at 31 December 2024 are held in the form of Common Equity Tier 1 Capital consisting of share capital, share premium and audited retained earnings. The Firm does not hold any Additional Tier 1 Capital or Tier 2 Capital.

Table 1 – Composition of regulatory own funds

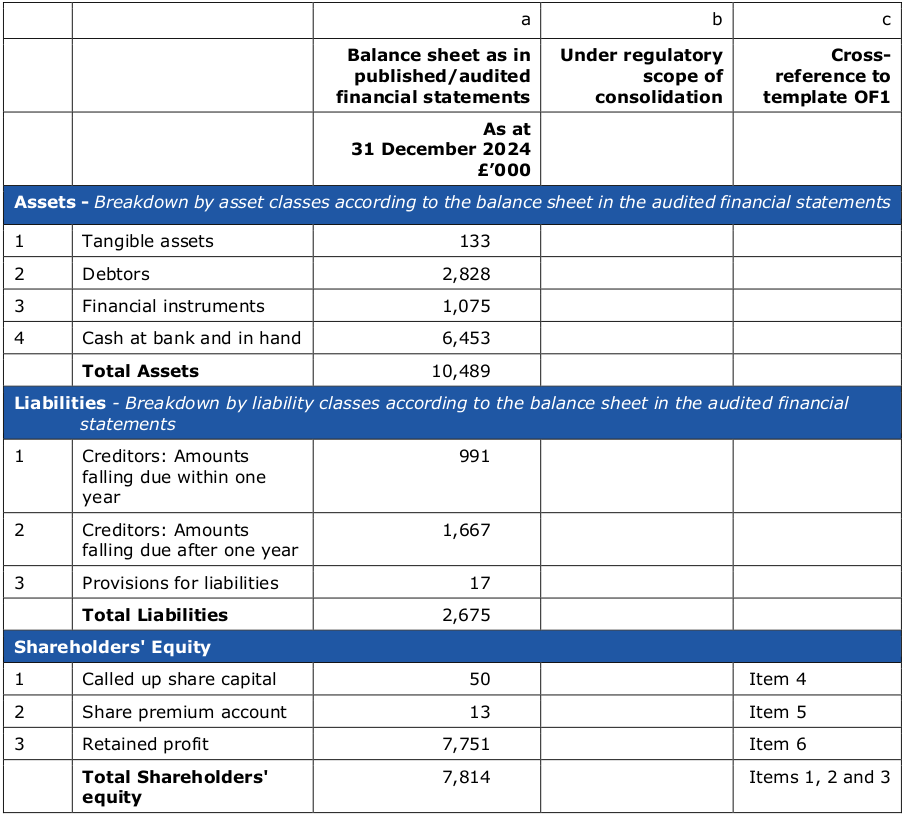

Table 2 – Own funds: reconciliation of regulatory own funds to balance sheet in the audited financial statements

The Firm is not part of a consolidation group so makes no distinction between column (a) and (b).

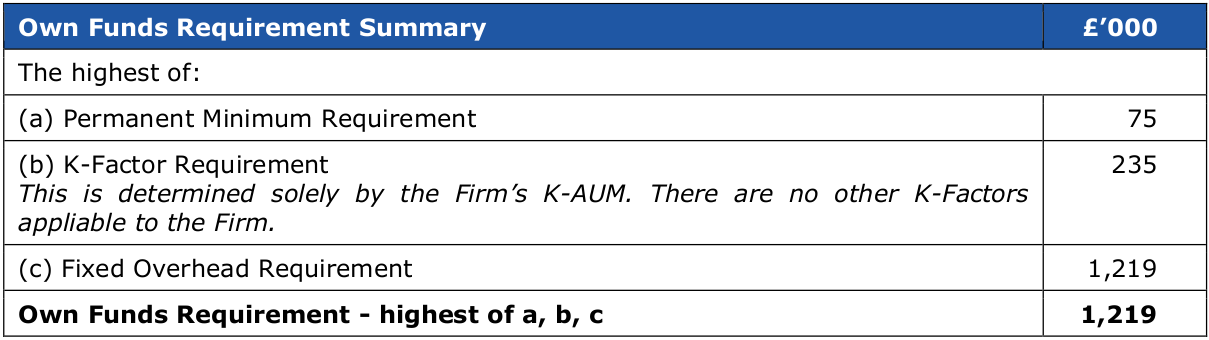

Own Funds Requirement

The Firm calculates its own funds requirements as a Non-SNI firm in line with the rules and requirements in MIDIFPRU 4.3 for Non-SNI firms. VenCap’s Own Funds Requirement is equal to its Fixed Overhead Requirement as this is greater than its K-Factor Requirement and Permanent Minimum Requirement.

The Firm’s Internal Capital and Risk Assessment (“ICARA”) and analysis ensures that the Firm has appropriate systems and controls in place to identify, monitor and, where proportionate, reduce all potential material harms that may result from the ongoing operation of its business or winding down its business. During the ICARA process, the Firm determines its own funds threshold requirement and liquid assets threshold requirement to mitigate the risk of harm from ongoing operations and to ensure the Firm could undertake an orderly wind down of its business. Liquidity stress testing is also conducted during the ICARA process.

The ICARA is reviewed annually or following any significant change to the Firm’s risk profile or business model.

Remuneration Policy and Practices

The Board has delegated authority to the Remuneration Committee to establish, implement and maintain remuneration policies, practices and procedures that are consistent with and promote effective risk management.

The Remuneration Committee is responsible for setting remuneration for all directors and employees and ensuring that it is aligned to the Firm’s business objectives, values, risk appetite, regulatory compliance and long-term sustainable success in order to support a high-performance culture.

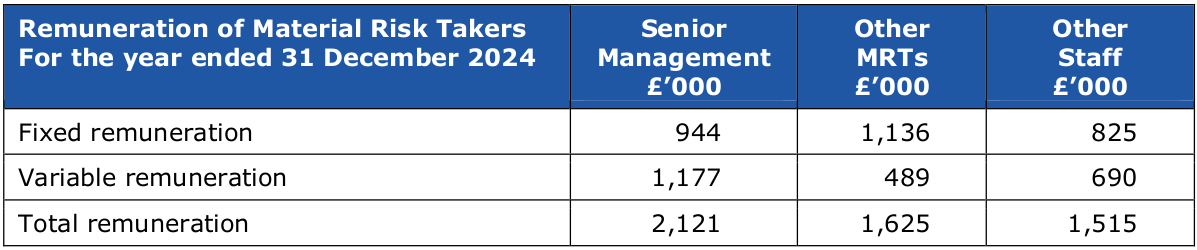

Job roles, responsibilities, individual performance, professional examination success and promotions are reflected in an individual’s remuneration. For the year ended 31 December 2024, remuneration comprised salary and variable remuneration in the form of carried interest incentives, fundraising and closing bonuses in respect of new funds raised, and discretionary bonuses. The amount of variable remuneration is unlimited in terms of there being no maximum percentage of remuneration set by the Firm that can be paid as variable remuneration compared with fixed remuneration.

The carried interest incentive schemes are aligned with the long-term interests of investors in the funds to which the Firm provides investment advice as any remuneration payable under those schemes is wholly dependent upon the realised performance of the relevant fund and independent of any other variable remuneration schemes. The carried interest schemes are subject to vesting over a commitment period of a number of years. As they are subject to return hurdles for investors being achieved, the carried interest is not usually paid until many years after a fund has been successfully raised and invested. All carried interest schemes are self-funded, i.e., the money to make such variable remuneration payments is received by the Firm before the Firm can make payments to staff.

The Firm has also awarded fundraising and closing bonuses (contractual or discretionary) upon the successful closing of new funds. The Firm has also, from time to time, paid other discretionary bonuses. All bonus schemes or awards are approved by the Remuneration Committee, which shall always consider the Firm’s financial resources, capital requirements and forecasts before awarding such variable remuneration.

The Firm has identified 13 material risk takers (MRTs) for the reporting year of which five are senior management and eight are other MRTs. No MRT received guaranteed variable remuneration or any severance payments in the reporting year.